lexington ky county property taxes

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. The preparation and printing of property tax bills.

Kentucky Property Tax Calculator Smartasset

That said each county in Kentucky determines what the property tax will be for the towns and cities within the county limits.

. The department analyzed researched and processed 12358 deeds in 2014 along with tracking changes to the 22680 mobile homes registered with the County. Technological advances allow for a more accurate description of a property and calculation. Median Property Taxes No Mortgage 844.

Tax Assessor Office Address. The Assessors Office must keep track of any changes in the 127000 parcels in Lexington County. Our Property Tax Division is located in Room 236 on the second floor of the Fayette District Courthouse at 150 North Limestone.

Average effective property tax rates in Madison County are lower than those in nearby Fayette County. Revenue is responsible for the collection of income revenues and monies due to Lexington-Fayette Urban County Government. 072 of home value Tax amount varies by county The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000.

The reader should not rely on the data provided herein for any reason. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Madison County is located in central Kentucky southeast of the city of Lexington.

Please send payments by mail to. Property Tax Search - Tax Year 2021. The Property Valuation Administrators office is responsible for.

859-252-1771 Fax 859-259-0973. Bills must be paid by money order cashiers check or certified check. The clerks responsibilities include.

Search building and planning records across the city. Fayette County Kentucky Property Valuation Administrator. Several government offices in lexington and kentucky state maintain property records which are a valuable tool for understanding the history of a property finding property owner information and.

Please select delinquent tax inquiry or call our office at 859 253-3344 for payoff information. That law has been responsible for the state real property tax rate declining from 315 cents per 100 of assessed valuation to just 122 cents. Ad Uncover Available Property Tax Data By Searching Any Address.

LexServ Occupational license fees on wages and net profits Landfill user fees Ambulance billings Insurance Premiums Tax Telecommunications Franchise Tax. Fayette County Property Valuation Administrator. Maintaining list of all tangible personal property.

Business licensing and taxes. 2019 Tax Rate - Real Property 278 per 100 2019 Revenue Potential - Real Property 139000 2019 Tax Rate - Personal Property 30 per 100 2020 Total Taxable Assessment 65000000 2020 Total Real Property Assessment 54000000 2020 Net New Property 2000000. Fayette County Property Tax Collections Total Fayette County Kentucky.

Information about zoning plans studies and survey information related to development Development records. Public Property Records provide information on land homes and commercial properties in Lexington including titles property deeds mortgages property tax assessment records and other documents. A Lexington Property Records Search locates real estate documents related to property in Lexington Kentucky.

Office of the Fayette County Sheriff PO Box 34148 Lexington KY 40588-4148 Please enclose a check or money order payable to Fayette County Sheriff along with your tax bill coupon. Recording and administration of various official documents. Various sections will be devoted to major topics such as.

If you cannot enclose a tax bill coupon please write the tax bill number account number and property address on your check. Property Tax - Data Search. The County Clerk serves as the countys official record-keeper.

Payments are accepted between 800 AM and 400 PM or until 600 PM through the month of October 2021 and parking is available in the public. Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year. The Fayette County Clerk is a separate agency from Lexington-Fayette Urban County Government.

Includes information about starting a business occupational license occupational tax and other tax details Development and zoning. All delinquent tax payments should be submitted by mail or drop box. Limestone Ste 265 Lexington KY 40507 Tel.

Any checks returned to the County will result in a reversal of the tax payment. This website is a public resource of general information. Property Taxes Mortgage 106970500.

Lexington ky county property taxes. The County Clerks Office is responsible for collecting delinquent property tax bills. 101 East Vine St Suite 600 Lexington KY 40507.

These dates have been established by the Legislature in an attempt to provide for the equitable and timely levy and collection of property taxes as well as continuity in PVA. Property Taxes No Mortgage 43540100. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

The Kentucky property tax calendar provides a general outline of the major statutory due dates for various parts of the property tax assessment and collection cycle. Why keep in touch with your local KY tax office. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein.

Payments may be made in-person at the Office of the Fayette County Sheriff. The reader should not rely on the data provided herein for any reason. Median Property Taxes Mortgage 1332.

The assessment of property setting property tax rates and the billing and. Kentucky Property Tax Payments Annual Kentucky United States. This website is a public resource of.

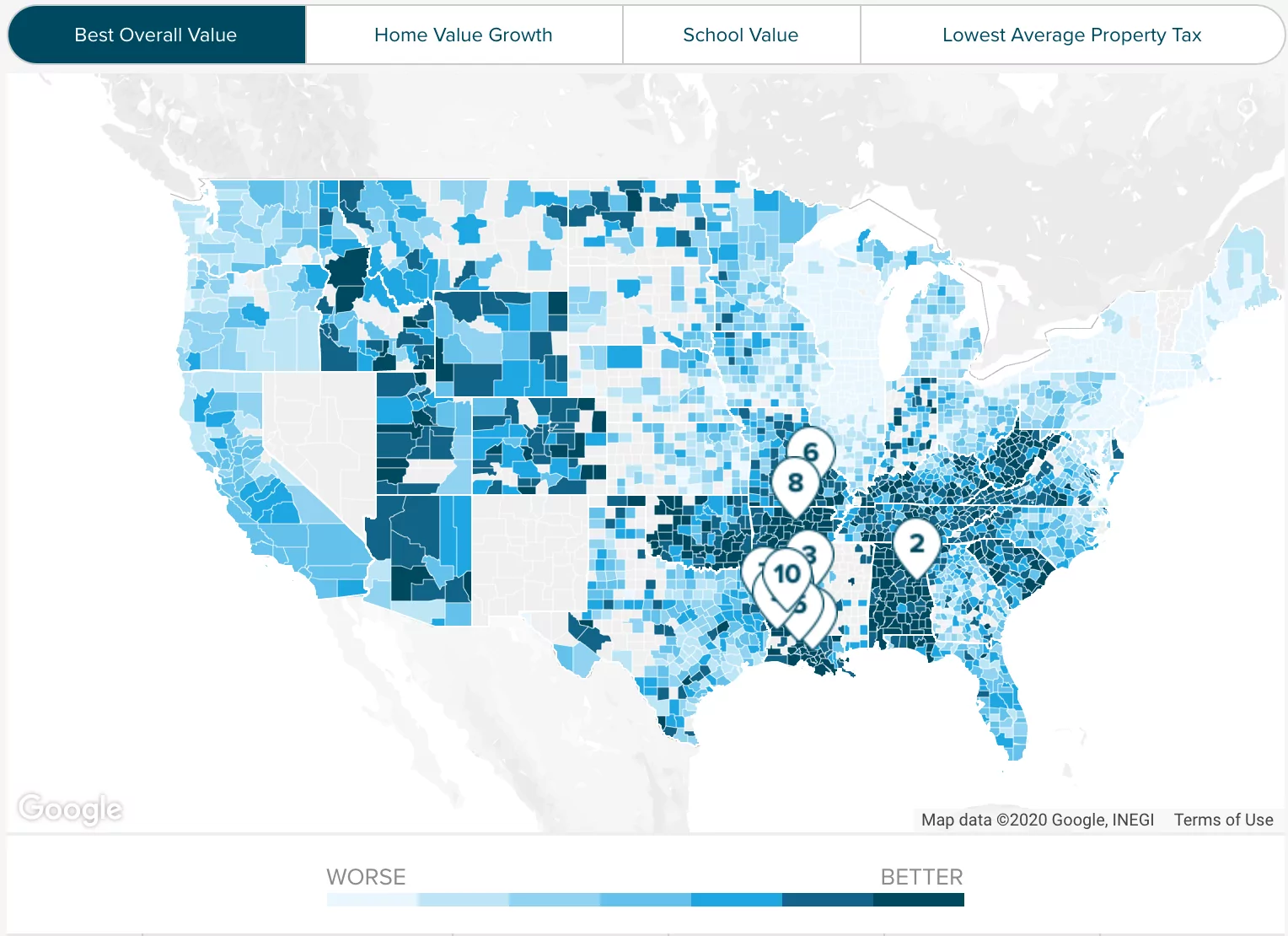

We Provide Homeowner Data Including Property Tax Liens Deeds More. Kentucky Property Taxes Go To Different State 84300 Avg. The average effective rate is 081 meaning a person with an 150000 home would pay an average of 1215 in property taxes annually.

Beginning 712015 Mental Health millage and funding are redistributed to General Fund County Ordinary Search for property information.

413 Marion Pike Real Estate House Styles Property

Wilmore Property For Sale Located At 605 East Main Street Wilmore Ky 40390 Including Photos Maps And Property Main Street Real Estate Listings Land For Sale

Lbar Com Listing 1118160 Lexington Lexington Ky House Styles

Contract To Closing Key Players And Their Responsibilities Infographic Sarasota Real Estat Real Estate Contract Real Estate Tips Getting Into Real Estate

Property Tax Faq Fayette County Sheriff S Office Lexington Ky

Kentucky Property Tax Calculator Smartasset

Newly Constructed Haddix Homes Available Oct2016 Home Construction House Styles

495 Dabney Dr Lexington Ky 40509 Mls 20102418 Zillow Lexington Zillow Electric Water Heater

See How Low Property Taxes In Kentucky Are Stacker

Chart 50 Highest Real Estate Tax Levies By Kentucky School Districts 89 3 Wfpl News Louisville

552 Avawam Dr Richmond Ky 40475 Homefinder Com Id 1524962 House Styles Richmond House

Kentucky Usda Rural Housing Loans Winchester Kentucky Usda Rural Housing Map For Eli Kentucky Map Rural

Jefferson County Ky Property Tax Calculator Smartasset